Formidable Info About How To Check Your Income Tax Return

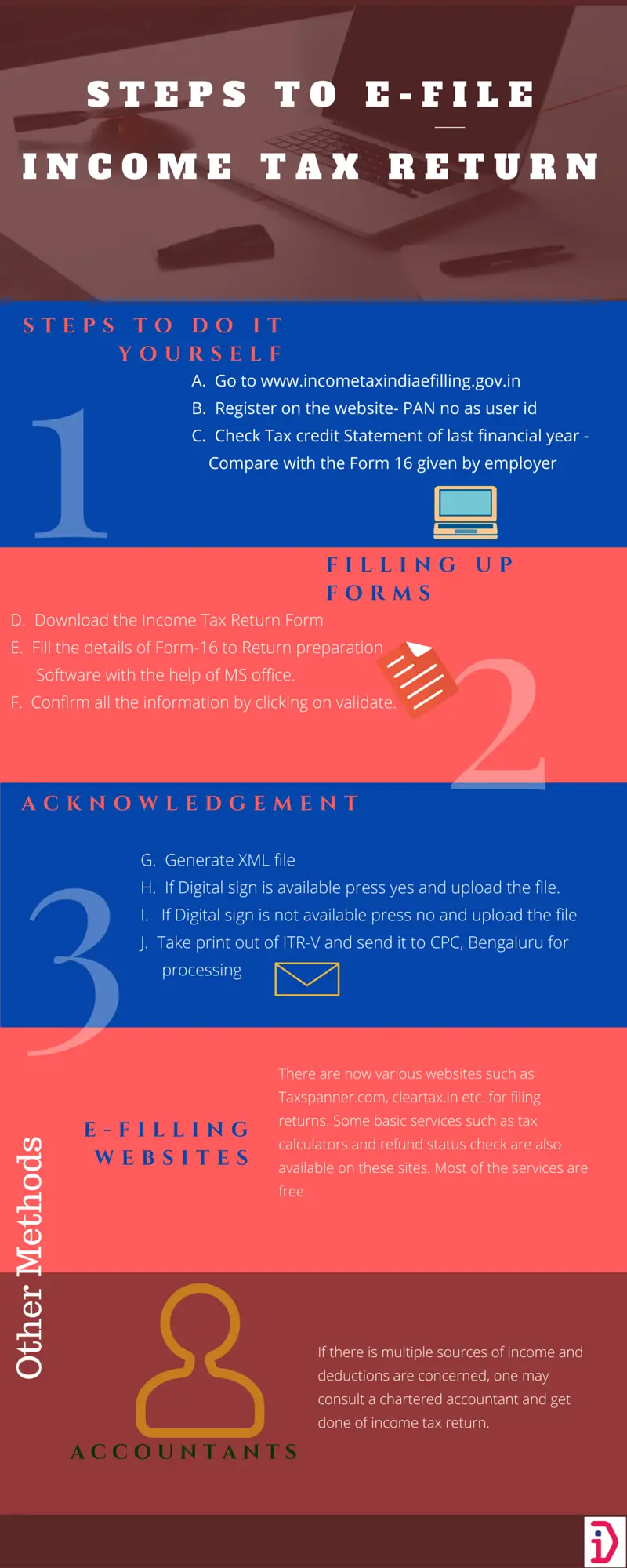

Sign in to check your federal return.

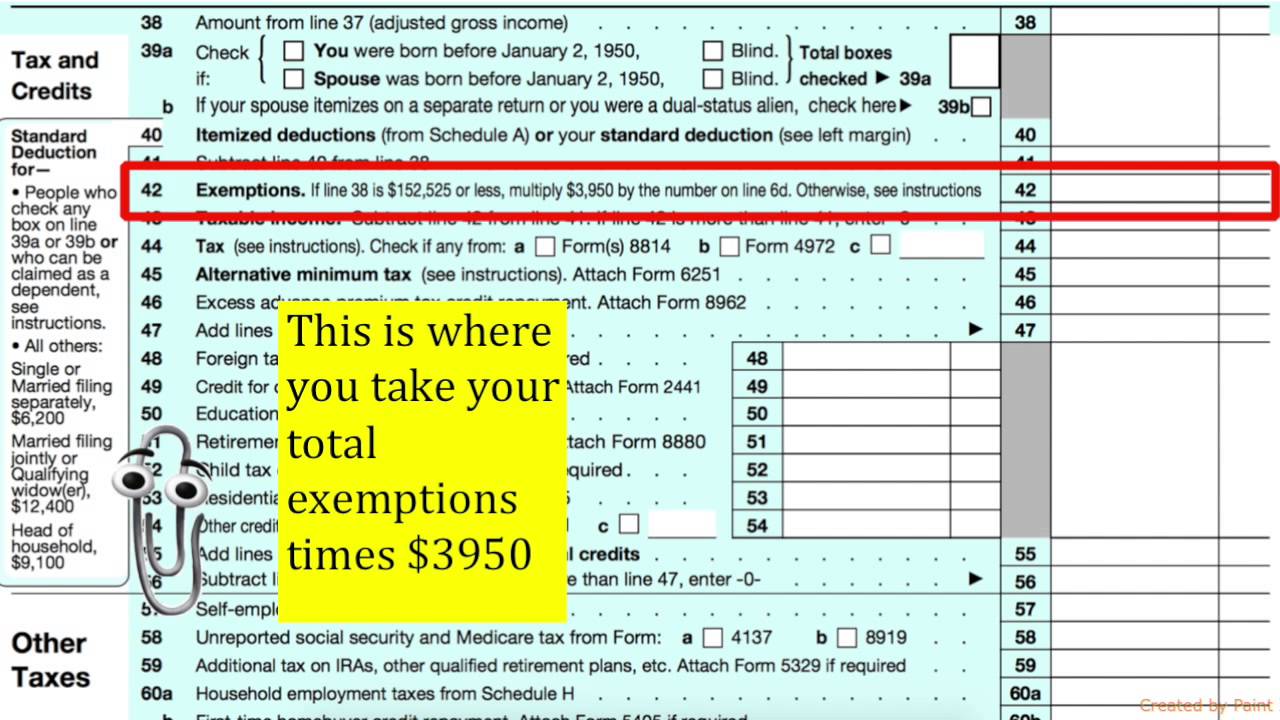

How to check your income tax return. What you need. Interest earned on your savings is classified as earned income by the irs. To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting.

Check your income tax for the current year. You can view the status of your refund for the past 3 tax years. The exact refund amount on your return.

All fields marked with an. Click income tax return (itr) status. Minors have to file taxes if their earned income is greater than $13,850 for tax year 2023.

Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. Go to the get refund status page on the irs website, enter your personal data then press submit. Your browser will redirect to requested content shortly.

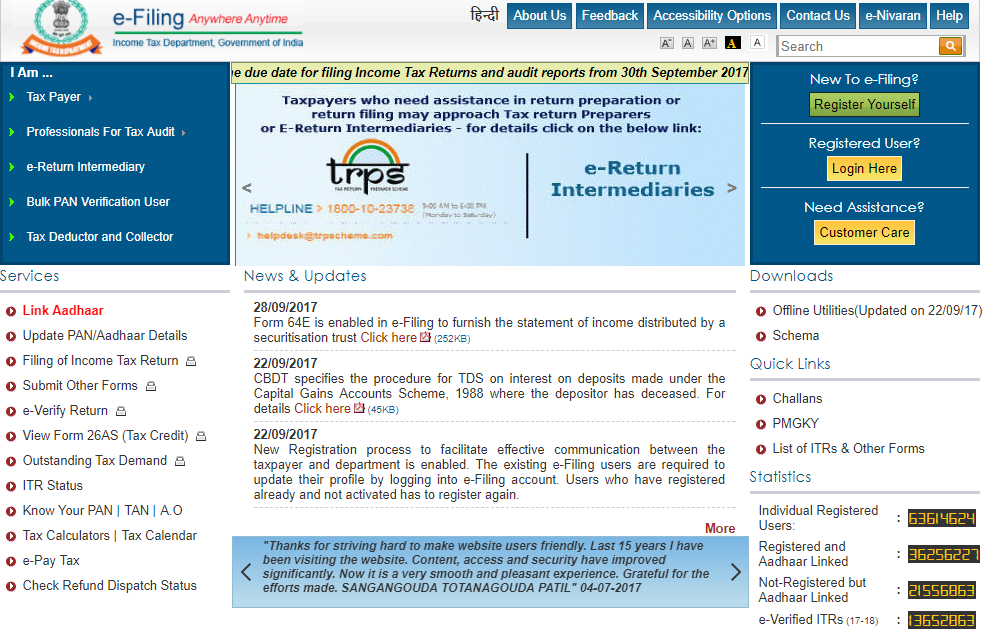

Status and make a note of your. Authenticate notice/order issued by itd. This is the fastest and easiest way to track your refund.

On the income tax return (itr) status page, enter your acknowledgement. Make sure you report all income—even savings account interest. The systems are updated once.

If you're a new user, have your photo identification ready. If you are receiving a tax refund, check its status using the irs where’s my refund tool. Sign in to your online account.

Use the irs where's my refund tool or the irs2go mobile app to check your refund online. Your social security or individual taxpayer id number (itin) your filing status. If your child only has unearned income, the threshold is $1,250 for tax year.

Please enter your social security number, tax year, your filing status, and the refund amount as shown on your tax return. Find your tax information in your online account or get a copy (transcript) of your tax records. Checking your browser before accessing incometaxindia.gov.in this process is automatic.