Matchless Info About How To Improve Credit Score With Collections

A credit score between 740 and 799 points is considered very good credit.

How to improve credit score with collections. Discover how many points your score can increase with our expert finance advice. Improve your credit score by removing collections. Increasing your score from fair (580 to 669) to very good (740 to 799) may help you save $22,263 over the life of your credit and loans, according to a new lendingtree study.

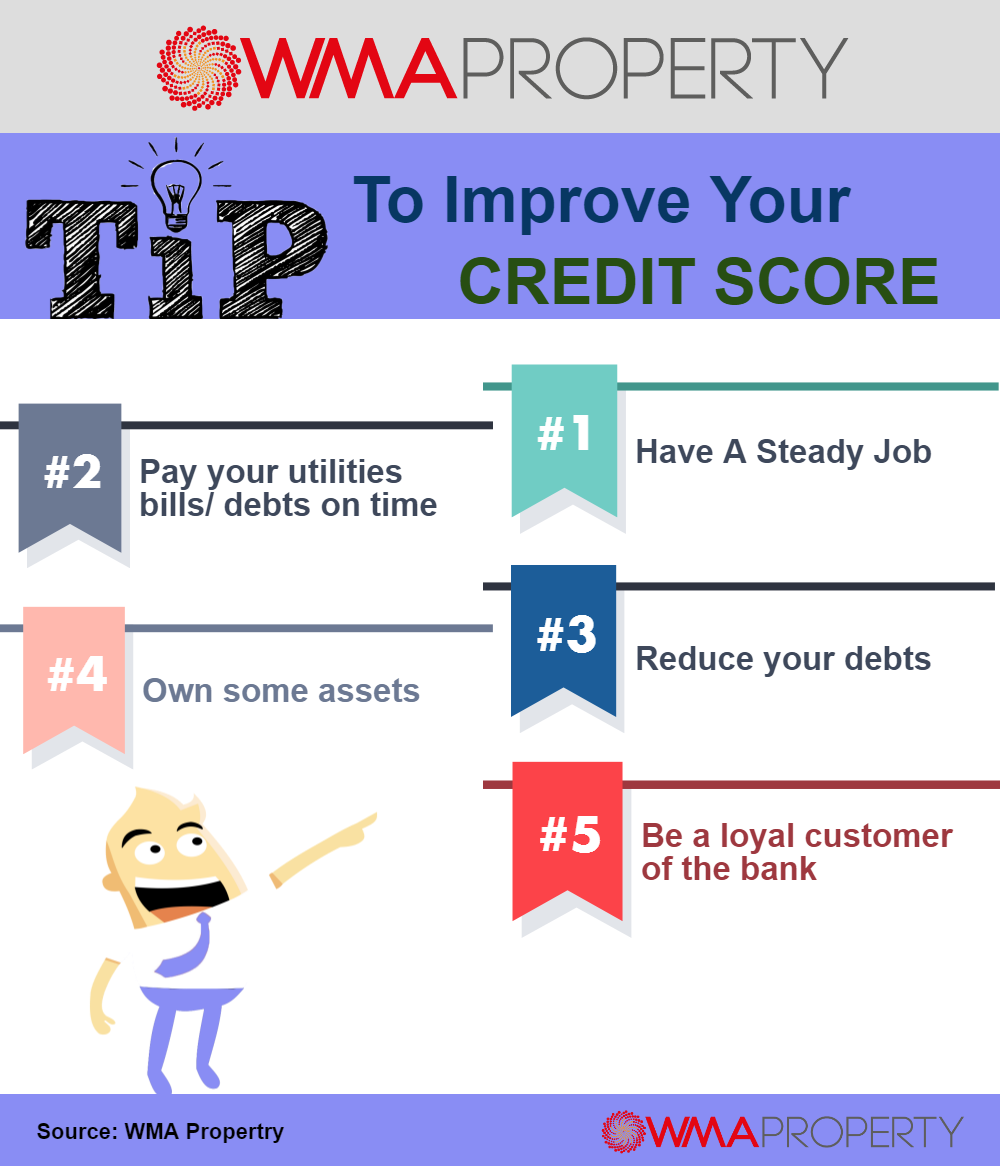

Here are the ranges experian defines as poor, fair, good, very good and exceptional. Settling versus paying a collection account in full there are two different ways to take care of your unpaid collections debt; Pay down your revolving credit balances if you have the funds to pay more than your minimum payment each month, you should do so.

Settling or paying in full. Newer scoring models weigh medical collections less harshly, so while paying them off will improve your score, paying off other types of collections will. Becoming an authorized user is one of the most popular ways to build your credit score because you benefit from someone.

The goal is you want to outweigh the negative accounts with. Published february 5, 2024 4 min read getting a credit card key points about: This is why applying for credit builder products is such a phenomenal way to improve your credit while it’s low.

(many of the links in this. Collections accounts on your credit report can linger for up to seven years and drag down your score. Paid debt collection the impact that paying off an account in collections has on your credit.

While collection accounts may not be immediately. Paying off collections can improve your credit score by reducing your overall debt and improving your credit utilization ratio. Get added as an authorized user.

In a nutshell having collections accounts on your credit report is bad for your credit score.

![7 Tips to Increase Your Credit Score [Infographic]](http://www.trimurty.com/blog/wp-content/uploads/2016/12/Infographic-7-01-1.jpg)