Fun Tips About How To Become Hud Approved Lender

Once you request an endorsement, your employer uses a specific management system to submit your documents to hud for certification.

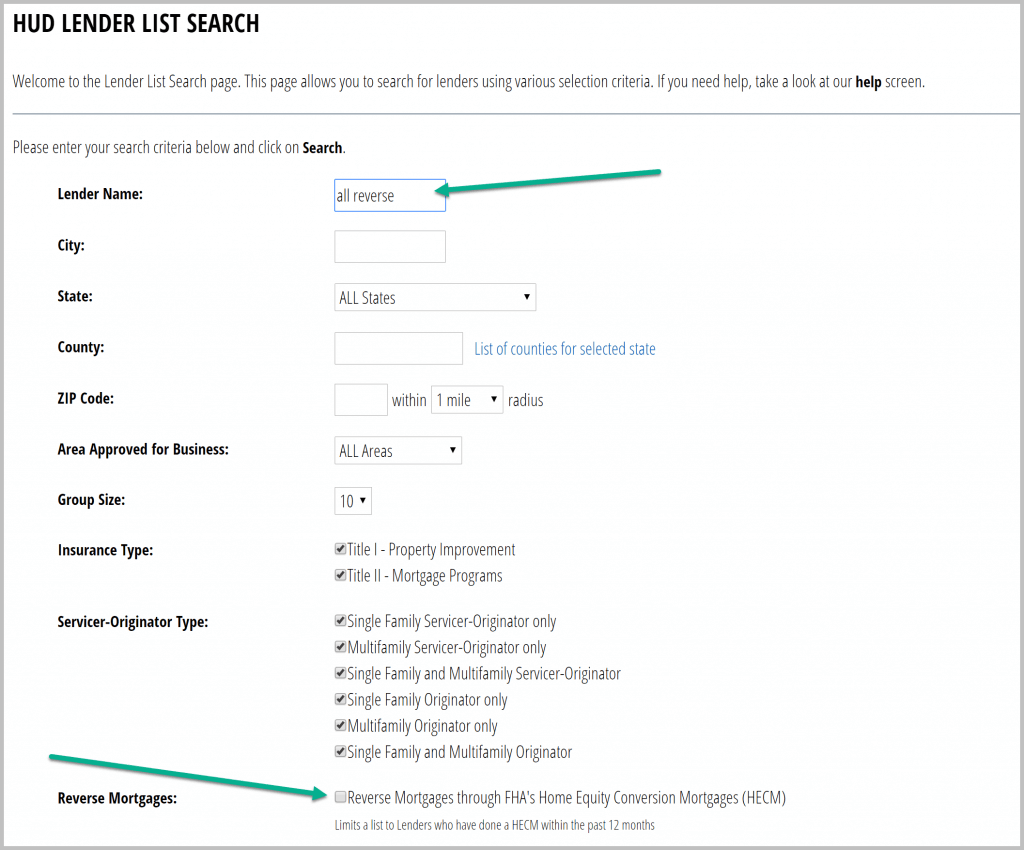

How to become hud approved lender. In order up qualify to become a hud. If you are an existing fha lender seeking to expand your approval to either title i or title ii, you must create a new request in leap to ‘add insurance authority.’ do not use this. Welcome to the lender list search page.

Section 184 participating lenders list. Hud also noted in that title i. Use hud’s online search tool to find options in your area.

Instructions for submitting applications to hud for approval. What happens when you call a housing counselor if you’re. To become a de underwriter, the lender certifies the qualifications of de underwriters and registers them with hud in a process called nomination.

If you need help, take a look at our help screen. After completing this course, the learner should be able to: However, hud permits roughly 200 lenders to offer these loans.

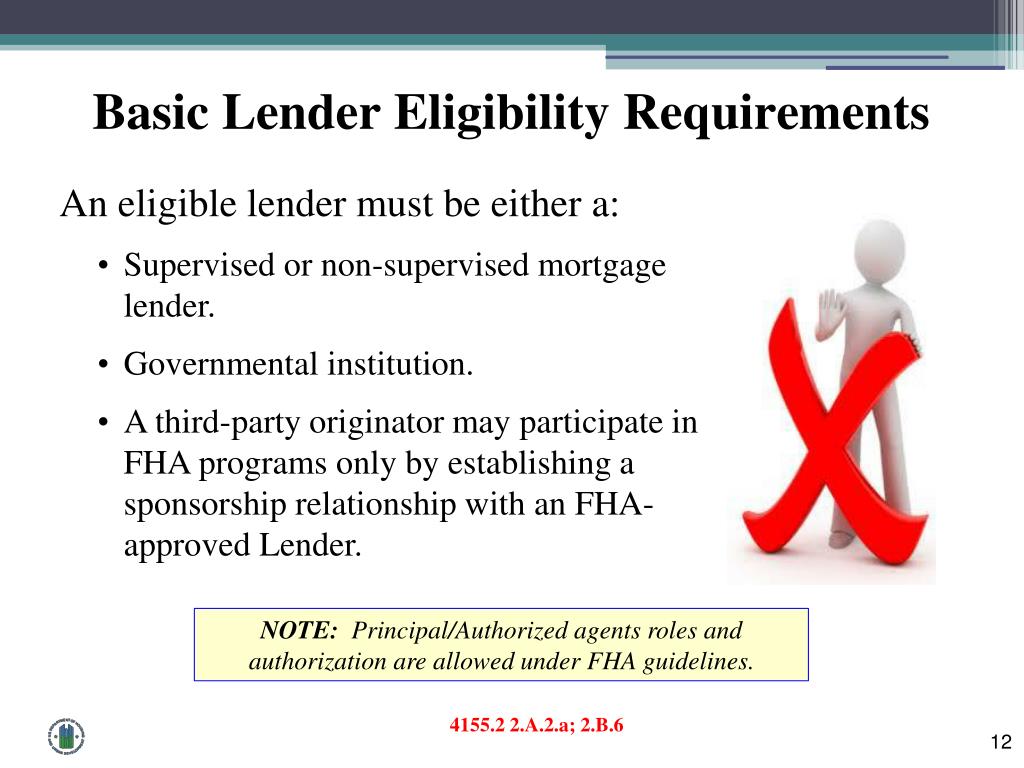

Lenders seeking fha approval must submit an online application containing all information and documentation required to demonstrate eligibility for approval as provided in the single family housing policy handbook 4000.1. Overview the institution profile function allows you to access and submit your organization’s annual recertification form, pay annual renewal fees online, and view your lending. Mortgage brokers do not need an fha lender approval.

The fha connection application coordinators. Federal housing administration (“fha”) approved lenders and mortgagees will no longer be required to register their branch offices. A mortgage broker can take an application and process it, but an fha approved lender must underwrite, close, and.

The us department of housing and. Please use the housing counseling agency eligibility tool to determine if your organization is ready to apply.

According to a recent study by the akwesasne housing authority, just one of those 200 lenders, 1st.