Beautiful Info About How To Claim Babysitting Income

What is the nanny tax?

How to claim babysitting income. Your mother is responsible for reporting babysitting income in the circumstance you have described. You might be wondering how to report or claim your babysitting income on taxes. For those classified as independent contractors, income and.

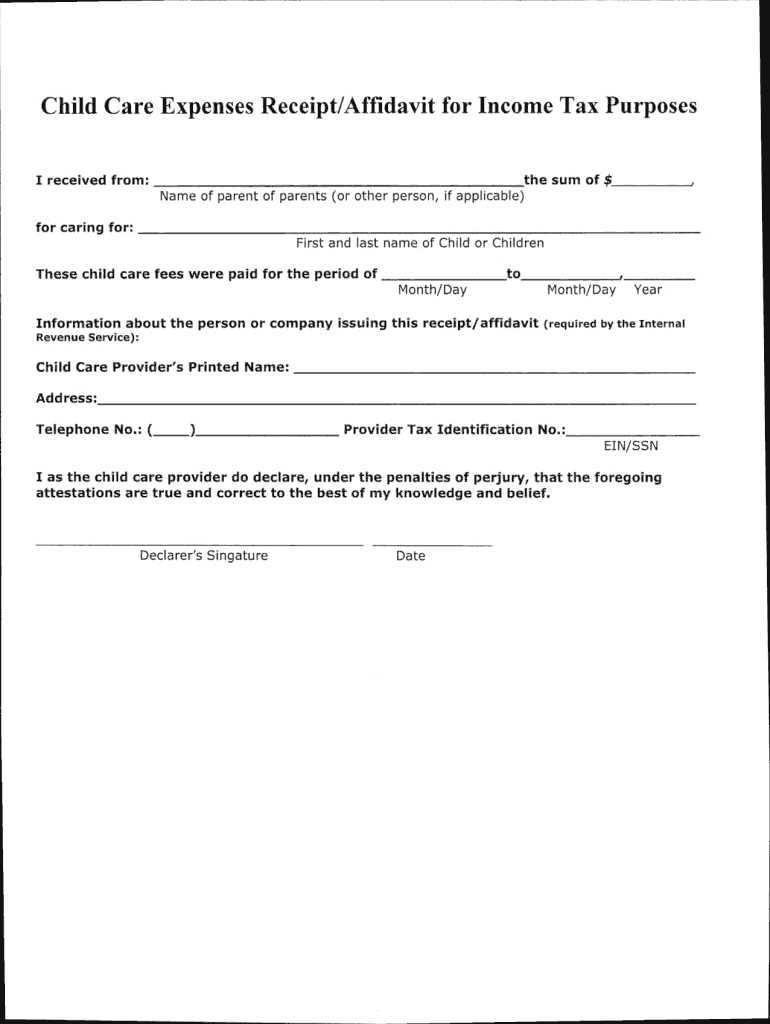

To make this easier, it is always useful to collect your receipts from your babysitting. To claim your babysitting expenses, you'll need to fill out schedule c of your tax form and attach it to your form 1040 for a regular personal income tax return. However, there may be some exceptions depending on the.

Open (continue) your return in turbotax online. Reporting babysitting income as wages is required if. How babysitters should report their income.

Generally speaking, if you earn income from babysitting, you will need to report it on your tax return. Sometimes parents may claim the transactions as childcare. To enter your babysitting income in turbotax:

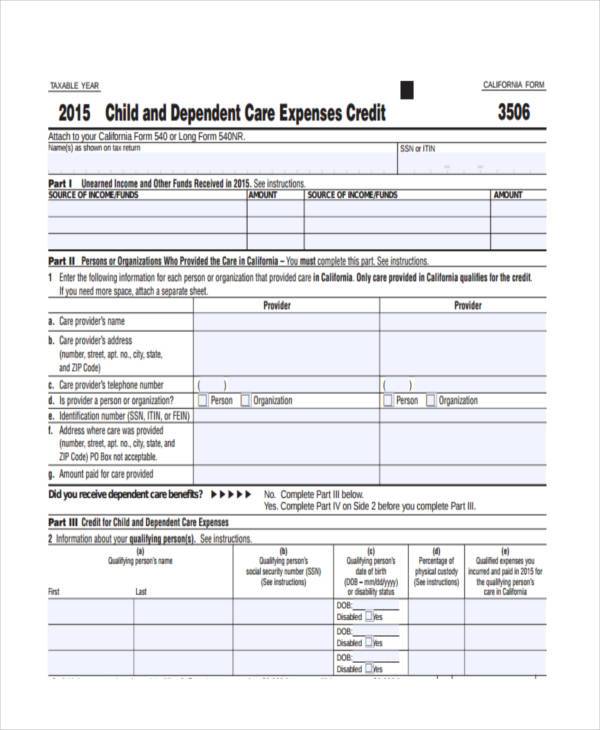

Updated 24 june 2022 first published 9 february 2019 as a parent, your expenses associated with babysitting might make you eligible for a tax credit or. Reporting income accurately to the irs is paramount. It is always useful to collect your receipts from your babysitting payments.

Maybe the word in your neighborhood is that you are a. According to the irs, babysitters do need to report their income when filing their taxes if they earned $400 or more (net income) for their work. The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee, such as a nanny or.

1 best answer turbotaxjeffrey new member if the amount is less than $3500 you can enter it as casual income (other employment income).